Navigating the Irish business landscape as a sole trader requires a clear understanding of the legal obligations surrounding bookkeeping. To ensure that your financial records are not only accurate but also fully compliant with the law here is an extract of the essential legal bookkeeping for sole trader requirements you need to adhere to. Yes, QuickBooks offers a free 30-day trial on our accounting software perfect for sole traders, freelancers and contractors. Sign up today to try out our accounting software features for your self-employed business before you commit.

- One approach is to use a physical or digital filing system that separates receipts by category, such as office supplies, travel expenses, or equipment purchases.

- At its core, bookkeeping involves recording and organising your financial transactions, such as sales, purchases, and expenses.

- Alternatively, many business owners choose to use commercial bookkeeping software.

- Start by importing credit card transactions into your bookkeeping software, then compare them with those in your accounting records.

- If you operate as a sole trader, you must keep tabs on any additional income you bring in personally.

- This includes income from sales or services and all expenses incurred in running the business.

- As a sole trader, you must use MTD-compliant software like any other business.

Managing expenses and invoices:

Before you take on any small-business bookkeeping tasks, you must decide whether a single- or double-entry accounting system is a better fit. The entry system you choose impacts how you manage your finances and how your bookkeeping processes will work. Prepare for Year-End and Tax Season – This involves summarising the year’s financial activities, organising records for tax filing, and evaluating the business’s financial health. So allow sufficient time for closing the books to reduce stress and last-minute rushes.

Need more time to do your taxes?

Include all relevant details (date, services, payment terms) to ensure clarity for both parties. The primary distinction between single and double-entry bookkeeping lies in the frequency of transaction recording. The accruals and cash basis in simple terms refer to when you record transactions in your books. There are resources online to help you get started with online bookkeeping, and your accountant will also be able to help you get started.

Mastering the Art of Inventory Management as a Sole Trader: Strategies for Success

With cloud-based accounting software, you no longer need to be at your office desk or computer to access your financial information. QuickBooks accounting software for sole traders makes it easier for self-employed business owners like you to do accounting wherever you are. Overall, as a sole trader, it is important to stay on top of your bookkeeping and comply with HMRC regulations. By keeping accurate records and using digital accounting software, you can make your bookkeeping easier and avoid any potential penalties or fines. Overall, accurate bookkeeping is essential for the success of your business.

These transactions can include sales, expenses, and purchases made using personal or business accounts. As a sole trader, it is essential to keep track of all monetary transactions and maintain records that can be used for tax purposes or audits. Furthermore, reviewing bank statements and reconciling accounts provides an opportunity to detect any discrepancies or fraudulent transactions.

- These tools offer a range of features such as expense and income tracking, invoice creation, and automatic bank account feeds.

- Because of these factors, advancing your bookkeeping career to a role in accounting can be advantageous.

- Try and go for software that will suit your business in the future as well as today.

- Because of its general nature the information cannot be taken as comprehensive and they do not constitute and should never be used as a substitute for legal, accounting, tax or professional advice.

- Start by reviewing historical records such as profit-and-loss statements from prior years or similar businesses in your industry to identify trends and set realistic revenue and expense goals.

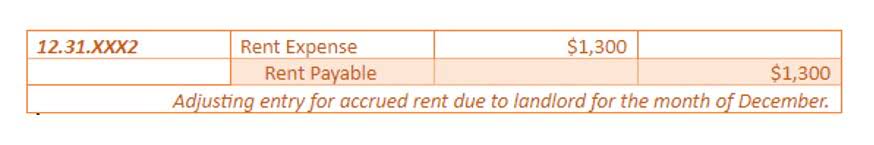

- A debit entry increases assets and expenses while reducing liabilities and income, whereas a credit entry increases liabilities and income while reducing expenses and assets.

- As with bank account reconciliations, regular reconciliation of credit card accounts is a vital aspect of effective sole trader record keeping and managing cash flow as a sole trader.

Most Common Bookkeeping Mistakes Sole Traders in Ireland Make

Instead, you will need to submit your self-assessment tax return on a quarterly schedule. A sole trader also must register for VAT if they have a turnover above £85,000 or want to reclaim VAT on sales made to VAT-registered businesses. Learners are advised to conduct additional research to ensure that courses and other credentials pursued meet their personal, professional, and financial goals. As of 2021, approximately 1.7 million people worked as bookkeeping, accounting, or auditing clerks. The BLS expects the field to have a 5 percent decline in growth from 2021 to 2031.

- You don’t have to file a separate business tax return as a sole proprietor.

- To make this process easier it’s recommended that you use an accounting system which automatically generates payment records as well as allows you import bank transactions.

- If you need assistance with bookkeeping or want to understand more about the best ways to go about it, get in touch with Reed Accountants.

- Connect your bank accounts, credit cards, PayPal, and more to pull in all income and expenses automatically.

- Anyone who earns income must track their business finances and file tax returns.

- Identify any discrepancies and mark them as outstanding items for investigation.

Sole Trader Bookkeeping: An Accountant’s Guide

The process involves sending estimates and invoices and keeping track of due dates. Some accounting software comes with invoicing features, like automated payment reminders, or you may opt for separate invoicing software. Accurate bookkeeping records allow sole traders to track their income, expenses, and overall financial performance over time.

- She went on to say that under MTD, sole traders will have to submit these records on at least a quarterly basis.

- You can use bookkeeping software to automatically categorise your income and expenses, or you can do it manually.

- Moreover, regular reviews help ensure that all transactions have been accurately recorded in your books.

- QuickBooks seamlessly integrates with over 500 apps you already use to run your self-employed business.

- There are many different types of financial ratios that you can use to analyse various aspects of your business finances.

Organising receipts and invoices

Proper bookkeeping is crucial for sole traders to manage their finances effectively, monitor cash flow, and comply with tax laws. One of the most important things you can do as a sole trader is keep accurate records of your business transactions for tax purposes. This includes keeping track of income and expenses, reconciling bank accounts, and maintaining up-to-date financial statements such as profit and loss statements. In conclusion, bookkeeping is an essential part of running a business as a sole trader. It involves recording and organising your financial transactions, including income, expenses, and taxes. Accurate bookkeeping is important for several reasons, including making informed business decisions, ensuring compliance with tax laws, and understanding your business’s financial health.